If you’ve recently inherited a house in Texas and don’t plan to keep it, selling may be your next step. This home inheritance guide explains how to handle joint ownership, avoid probate, siblings, taxes, and the real estate process when multiple family members are involved.

*updated 2-5-26

Sell Inherited Property with Multiple Owners in Texas

Selling inherited property with multiple owners in Texas can get complicated fast.

If you’re trying to get an inherited house sold quickly, and it’s shared between siblings or other relatives, you’re probably already feeling the weight of legal paperwork, emotional ties, and competing priorities.

Maybe it’s you and your sister.

Maybe it’s a cousin or two.

No matter who’s on the title, figuring out how to sell an inherited house as a group takes more than just good intentions. It takes a clear plan.

This real estate inheritance guide walks you through everything from how to avoid probate court approval and property taxes to capital gains, co-owner disputes, and finding the right buyer.

Understanding Inherited Property and Joint Ownership in Texas

What is Joint Property Ownership in Texas?

When you inherit a house with others, you don’t just get a set of keys.

You inherit a shared responsibility.

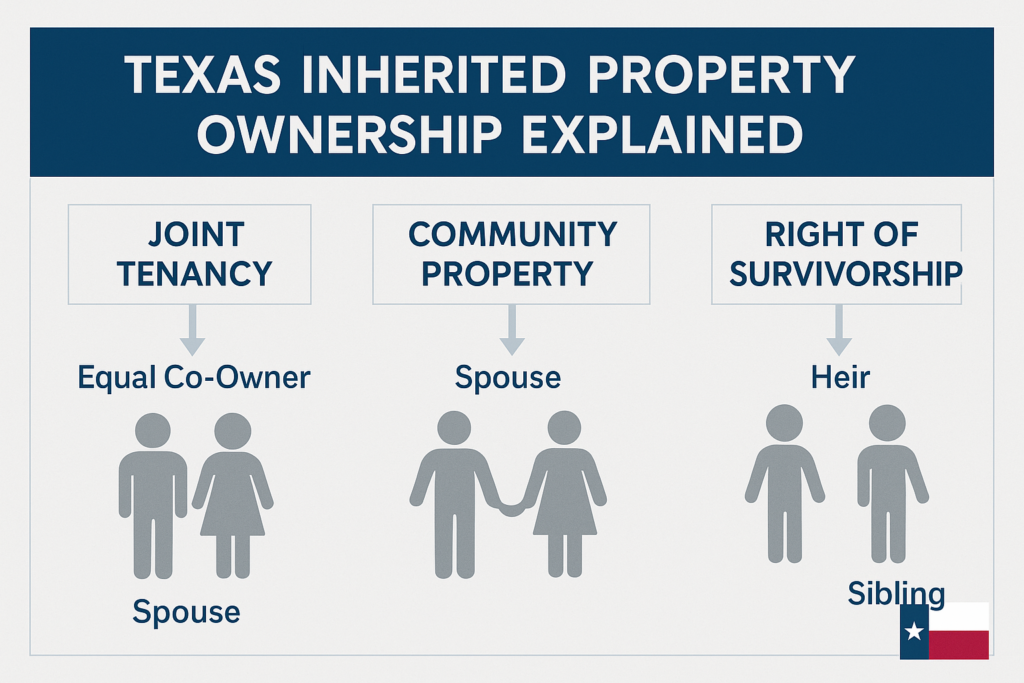

In Texas, jointly owned property means two or more people legally own a piece of real property together. This often happens after a death in the family, where siblings or relatives suddenly find themselves co-owners of an inherited house.

One common setup is called joint tenancy.

In this arrangement, everyone has an equal share.

If one person passes away, their share doesn’t go through the will or probate court. It automatically goes to the surviving co-owners. That’s called the right of survivorship, and it can simplify things, but only if everyone’s on the same page.

Texas law also recognizes community property, especially when the deceased person was married.

The surviving spouse may inherit part or sometimes all of the home, depending on what the estate planning documents or Texas inheritance rules say.

Here’s the bottom line.

Whether you’re dealing with joint tenancy in common, community property, or other forms of shared ownership, understanding the legal action and structure behind your inherited real estate is key.

It affects everything from decision-making to how the home is eventually sold.

When Inheriting the Family Home Creates Tension

Inheriting property sounds simple on paper.

But when multiple owners are involved, things can get complicated fast.

One sibling wants to sell for cash. Another wants to keep it for rental income. Someone else is emotionally attached and refuses to let go.

This is the reality to sell inherited property with multiple owners in Texas, and it’s more common than most people expect.

The home might have sentimental value. Maybe it was your childhood house. Maybe a vacation home. Maybe it belonged to a grandparent who meant the world to you.

These emotions are real, and they can make it harder to make practical decisions about the property.

Then there’s the money side.

Who’s paying the property taxes?

What about the mortgage payments or necessary repairs?

If one owner can’t contribute, the burden shifts to the others.

That’s where tension starts to build.

This is why open communication and a clear written agreement matter so much. Everyone needs to be on the same page.

Without it, small disagreements can quickly turn into legal disputes, especially when the property’s future and your family relationships are at risk.

Legal Processes and Estate Planning for Inherited Properties

The Role of Probate Process to Sell Inherited Property

Probate law may sound intimidating, but in Texas, it’s just the legal path a property takes after someone passes away.

If you’re selling inherited property with multiple owners in Texas, understanding the probate process is a key part of getting that house sold legally and fairly.

Probate is where the estate gets sorted out.

The court steps in to make sure the right heirs receive the right assets including real property.

That might mean settling debts, clearing title issues, or confirming who legally owns what. If there’s confusion about property ownership or if even if one heir doesn’t agree on the sale, the court may even need to approve it.

In some cases, there’s a probate process shortcut. It’s called an affidavit of heirship. This is a legal document that outlines who the rightful heirs are and how they’re connected to the deceased person. If everyone involved agrees, this affidavit can help skip the full court process and speed up the property transfer.

But that only works if the title is clear and no one’s contesting ownership.

Otherwise, probate court might still need to step in before a sale of the property can move forward.

Planning for the Distribution of Proceeds

A little planning before death can save a lot of stress after it.

When a living trust is in place, it keeps inherited property out of probate entirely.

Ownership passes directly to the chosen heirs, making it much easier to sell the property and distribute the proceeds. It’s a smart move that often prevents family disagreements and long delays.

Without a trust or will, things fall under intestate succession.

These are default Texas laws that decide who gets what when someone dies without an estate plan.

Property Address

Shares of ownership go to the surviving spouse, children, or other relatives depending on the family structure. It’s all laid out by law, but it can get complicated quickly when more than one person is entitled to a piece of the property.

Selling the home requires everyone to cooperate.

But when you have multiple owners, that’s not always easy.

If even one person disagrees, the sale could stall… or wind up in the probate process in court.

This is where a probate attorney becomes extremely helpful. They can clarify ownership, guide you through the sale process, and help make sure the proceeds are divided correctly.

With legal support, families can avoid drawn-out disputes and move forward with a sale of the property that works for everyone involved.

Key Tax Implications for Multiple Heirs

Taxes may not be the first step on your mind when you’re selling an inherited house, but ignoring them can cost you.

If you’re selling an inherited home with multiple heirs in Texas, it’s important to understand how taxes can affect your bottom line, especially if the property has gone up in value.

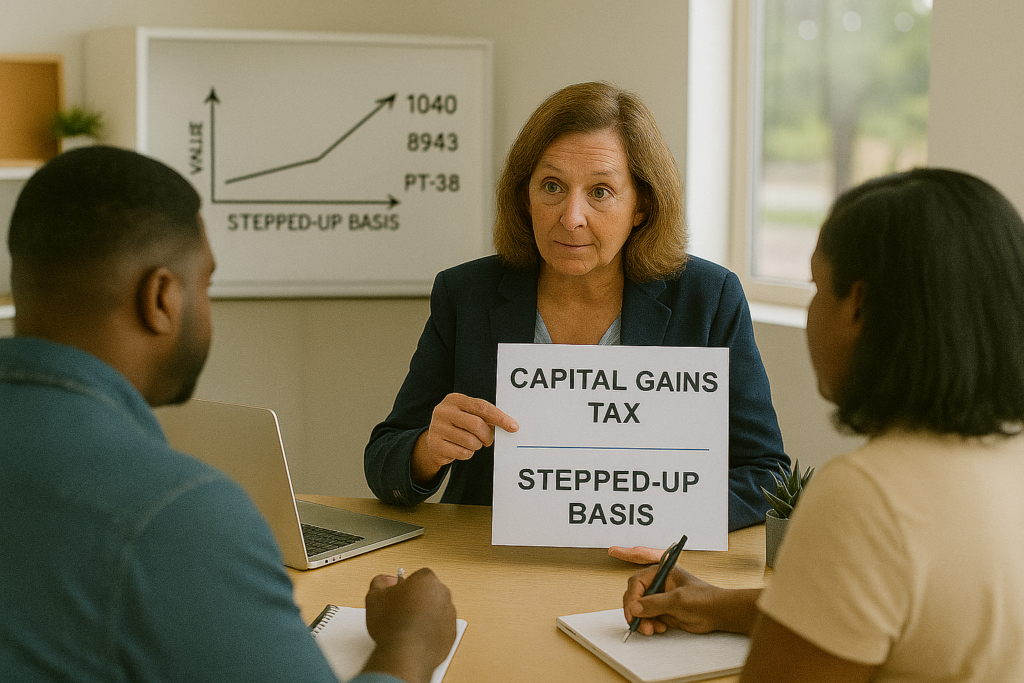

Let’s start with capital gains tax.

Normally, if you sell a house for more than you paid, you owe taxes on that profit.

But inherited properties get something defined by the IRS as stepped-up basis.

That means the home’s value resets to its fair market value on the day the original owner died. So instead of being taxed on decades of appreciation, you’re only taxed on the difference between the value at inheritance (not original purchase price) and the final selling price.

For most families, that makes a huge difference.

Then there’s the federal estate tax, which sounds scary but usually isn’t.

In 2026, the IRS exemption is high enough that most estates don’t owe anything. Unless the estate is worth several million dollars, you’re probably in the clear.

Texas doesn’t have an inheritance tax, which helps. But if you inherited real estate from out of state, you’ll want to double-check local rules. Some states still impose inheritance or estate taxes, and they can reduce what you take home from the sale.

Don’t forget about rental income either. If the house was rented before it sold, that is still taxable income.

And any outstanding mortgage or property debts will also come into play when it’s time to divide up proceeds. Knowing and calculating what taxes you owe upfront can save everyone a headache later.

How to Handle Complex Tax Rules

Tax implications and scenarios can get complicated quickly: life estate deeds, unpaid debts, and multiple heirs all add layers that can affect the sale and final payout.

This is where a financial advisor can really help.

They’ll walk you through the numbers, explain how the tax rules apply in your situation, and offer ways to reduce what you might owe. Their job is to make sure everyone involved understands how federal and state tax laws impact the distribution of proceeds.

If the property was passed down using a life estate deed or a transfer on death deed, there could be extra tax burden and financial implications to consider.

These tools can help skip probate, but they sometimes lead to surprises when the home is sold. The timing of the sale, how the property value is recorded, and what paperwork is in place all matter.

Don’t forget about debts tied to the home.

Mortgages, liens, or unpaid property taxes usually need to be paid before any money is split between heirs. That can cut into what each person actually receives from the sale.

Sorting out these tax and debt questions in advance helps keep things clear. It can also avoid delays, family disputes, or unexpected bills from the IRS.

Inheriting a home is already emotional.

The financial side doesn’t need to add more pressure.

Preparing the Inherited Property for Sale

Assessing the Property’s Value and Market Trends

Before selling an inherited property, you need to know what it’s actually worth.

That starts with looking at the basics.

Consider the home’s location, current property condition, and how similar properties nearby have recently sold. A realistic valuation gives you a strong starting point and helps set a price that attracts serious buyers.

Texas real estate trends vary widely across different cities and counties.

In some areas, low inventory and high demand create a seller’s market where homes move quickly and often sell above asking. In others, buyers have more negotiating power, and it may take longer to find the right offer. Understanding the local market helps you choose the right time to sell.

Then there’s the property itself.

Some inherited homes need repairs or updates before they’re ready to list.

Small improvements can increase the home’s value, but only if they make financial sense. If the cost of repairs is too high compared to the expected return, it might be better to sell house as-is.

Getting these details right from the start can help avoid delays, reduce stress, and lead to an easier home sale for everyone involved.

Selling Process: Finding the Right Buyer for Your Property

Benefits of Selling to a Cash Buyer

Selling to a cash home buyer is often one of the simplest ways to handle the sale of inherited property quickly, especially when multiple owners are involved.

Cash buyers, such as real estate investors like Uncle Tex Buys Houses, typically purchase homes as-is, eliminating the need for costly repairs or upgrades.

This can be particularly advantageous if the property requires significant work or if the owners want to avoid the time and expense of preparing it for the open market.

One of the biggest advantages of working with a cash buyer is the speed of the transaction.

Unlike traditional home buying processes, where financing and inspections can delay the sale, cash buyers can often close deals within days or weeks.

This expedited timeline can be especially helpful for families looking to settle the estate quickly or avoid ongoing expenses such as property taxes, mortgage payments, and maintenance costs.

Cash buyers also provide a straightforward solution for owners who may not agree on how to handle the property.

By offering a fair price and a hassle-free selling process, cash buyers help reduce conflict among family members, ensuring a smoother resolution.

Companies like Uncle Tex Buys Houses specialize in working with families in Texas, offering competitive and fair offers tailored to the local real estate market.

Property Address

Listing on the Open Market

Another option for selling an inherited property is to list it on the open market.

While this approach can take more time, it may result in a higher selling price, particularly if the home is in good condition and located in a desirable area.

Listing the property with a real estate agent ensures that it is marketed effectively to attract potential buyers and secure competitive offers.

However, selling on the open market in Texas comes with its own set of challenges.

Agent fees, which typically range from 5% to 6% of the sale price, can significantly impact the proceeds from the sale.

Additionally, the process may involve staging the home, conducting showings, and negotiating with buyers, all of which can take weeks or even months. Owners must also be prepared to handle requests for repairs or seller concessions, which can further delay the sale.

For families who can afford the time and effort required, listing on the MLS for traditional homebuyers can be a viable option for maximizing the home’s value.

It’s important to work with a real estate agent experienced in the local DFW market to ensure the property is priced competitively and marketed effectively.

This approach is best suited for owners who are willing to invest in the selling process to achieve the highest possible return.

Legal and Financial Support for a Successful Sale

When to Seek Professional Guidance

Selling real estate inheritance with multiple owners or heirs in Texas involves more than just paperwork.

Between probate court, tax rules, and title concerns, the process can be legally and financially complex.

A probate and real estate attorney can help you handle the legal process, clear the property title, and resolve any disputes between co-owners. Without a clean and clear title, the sale could fall apart at closing.

A financial advisor can walk each owner through tax obligations, including capital gains tax, federal estate tax, and any outstanding debts tied to the property. Their guidance helps ensure that proceeds are divided fairly and in compliance with Texas law.

Understanding the legal requirements for a real estate transaction is key to avoiding costly delays. Working with professionals helps you prepare the necessary documents, follow state law, and protect the financial outcome for everyone involved.

Managing Emotional and Financial Aspects

Selling an inherited home can be emotionally difficult, especially when the property carries family memories or sentimental value.

It’s common for co-owners to disagree on whether to sell, keep, or rent the house. Open communication can help align expectations and keep the process respectful.

Personal belongings in the home can add to the emotional weight. Deciding what to keep, donate, or leave for the buyer requires mutual agreement. Taking time to honor the memory of the deceased person can make the transition easier for everyone.

Financially, it’s important to ensure a fair distribution of proceeds.

A written agreement that outlines ownership shares and responsibilities helps prevent misunderstandings. This is especially true when the property has outstanding debts, a mortgage, or tax obligations that must be addressed before closing.

By combining legal advice, financial planning, and open family dialogue, you can work toward a successful sale that respects both the people and the property involved.

Frequently Asked Questions

| Question | Answer |

|---|---|

| Can we sell if one co-owner refuses? | Yes—Texas law allows a partition action or a buy-out, but a cash offer accepted by all heirs is usually faster and cheaper. |

| How do we split the sale proceeds? | Each owner is paid at closing according to the recorded ownership percentages or a written agreement. |

| Do we need probate if all heirs agree to sell? | Often no. An Affidavit of Heirship can clear title without full probate when every heir signs. |

| How fast can Uncle Tex close a multi-owner inherited sale? | We close in 7–14 days once clear title is confirmed—no repairs, clean-outs, or agent fees. |

Your Next Steps for Selling an Inherited Property

If you and your family are trying to sell a home that’s been inherited by multiple owners and heirs, you’re likely juggling a mix of legal questions, emotional considerations, and financial decisions.

From probate court orders and property taxes to family dynamics and paperwork, every step comes with its own complexities.

The good news is, with the right information, clear communication, and a solid plan, you can move forward without conflict or delay.

The most successful sales happen when families prepare early, understand their options, and bring in professional help when needed. Whether that means hiring a probate attorney, consulting a financial advisor, or choosing to sell the property as-is, there’s no one-size-fits-all answer.

You need a path that works for your situation.

If you’re looking for a fast, straightforward way to sell an inherited home in Texas, especially when multiple owners are involved, companies like Uncle Tex Buys Houses can help.

With over 2,800 real estate transactions completed, we specialize in working with families, offering fair cash offers and local experience you can trust.

No pressure. Just real solutions, right when you need them.

Contact Us

We would love to hear from you! Please fill out this form and we will get in touch with you shortly.

** Disclaimer: This complete guide is intended for general informational purposes only and does not constitute legal, tax, or financial advice. Every property owner’s situation is different, especially when dealing with inherited homes, joint ownership, or the partition action process. Whether you’re considering a property sale, facing a partition lawsuit, or determining how property interest and tax considerations affect your estate sale, it’s important to consult legal counsel licensed in your state. State-level inheritance laws vary, and decisions about a primary residence or inherited property should always be made in your best interests. Readers are encouraged to speak with a real estate attorney, tax professional or financial advisor to understand the inheritance process and make the best decisions for their unique circumstances.

*** About the Authors: Hilary Schultz is a licensed Texas Realtor and a Zillow Top Agent recognized for guiding families through complex real estate situations, including selling inherited property with multiple owners in Texas. She and her husband Patrick Schultz have 2,800 real estate transactions completed through their family-run, Texas-based business. Hilary also serves on the executive board of her local Texas PTA, demonstrating her ongoing commitment to the community. Her experience in real estate spans valuation, legal coordination, and client-focused solutions. You can verify her license through the official Texas database. To read more about their background and approach, visit the about us page. Her Top Agent badge on Zillow highlights her service record. For feedback from past homeowners, check out verified client reviews.