*updated 2-5-2026

Analyzes the upcoming silver tsunami of inherited properties expected to impact the Texas housing market beginning in 2026, as baby boomers age out of homeownership. This explainer examines projected demographic shifts, probate-related delays, and regional housing supply trends in Dallas-Fort Worth to anticipate how the anticipated great wealth transfer in real estate transfers may affect affordability, inventory, and market behavior.

The Silver Tsunami of Inherited Properties in Texas

A wave of inherited homes is crashing onto the Texas housing market—what experts are calling the “silver tsunami of inherited properties.” With baby boomers set to pass down trillions in real estate inheritance, the ripple effects are just beginning.

With baby boomers set to transfer $17 trillion dollars of home equity according to Freddie Mac, this mega-trend is not only reshaping home prices and home values but also presenting new opportunities and challenges for homeowners, homebuyers, and younger generations across Texas and DFW.

Survey data reveals that approximately 75% of boomers intend to pass down their residential property or its value to their children. The resulting transfer of assets will create meaningful financial benefits for inheriting generations.

The aging population of baby boomers will drive significant shifts in Texas homeownership. With many older residents passing away or transitioning to retirement age, an increasing volume of inherited properties will enter the housing market.

As Texas experiences this wave of real estate inheritance in cities like Dallas, San Antonio, Austin, and more locally in DFW areas like Arlington and Plano TX will feel the effects and substantial changes in housing supply and demand.

Whether you’re a real estate agent, a first-time buyer, or a family member managing all the contents at an inherited property, understanding this phenomenon nicknamed the “Great Wealth Transfer” is key to staying ahead in an evolving real estate market.

What Is the Silver Tsunami and Why It Matters in Texas?

Silver Wave Meaning

The silver tsunami meaning refers to the significant demographic shift caused by the aging population.

This intergenerational transfer of wealth has profound and financial implications for homeownership trends and the Texas housing market.

As a large number of older residents pass away or transition to retirement age, their properties are often inherited by family members or sold in the market. This creates a ripple effect, shifting real estate dynamics on a local and national level.

Real estate inheritance is becoming a dominant factor in shaping the future of homeownership. In Texas, this wealth transfer is particularly impactful due to its growing population and large housing market.

For younger generations, this trend represents both an opportunity to enter the market and a challenge, as they work through affordability concerns with rising property taxes and insurance rates which alters home values.

Key Texas Cities Affected

Major cities in Texas are at the forefront of the silver tsunami.

Dallas-Fort Worth, for instance, has become a key hub for inherited property sales.

As one of the fastest-growing metro areas in the United States, the DFW metroplex will see an influx of inherited homes enter the for sale market, creating opportunities for homebuyers while also shifting housing demand and supply equilibrium.

Other metro areas like Houston, Austin, and San Antonio are experiencing similar trends. These cities will witness a similar increase in available single-family homes due to real estate inheritance, which will reshape suburban and urban housing markets.

However, the impact isn’t confined to Texas alone—national trends show similar shifts in cities like Los Angeles, Salt Lake City, and New Orleans.

The Housing Market Impact Across Texas and Beyond

Ripple Effects on Home Prices and Housing Shortage

The silver wave of housing supply will cause significant reevaluation of home prices to counterbalance in the increase in housing supply, especially in Texas.

As more inherited properties enter the market, housing supply will increase, but not necessarily in affordable housing sectors. Many of these homes are in areas where affordability challenges persist, making it difficult for young workers and first-time homebuyers to enter the market.

In expensive coastal job centers and metro areas, denser construction is becoming a viable solution to address the housing affordability crunch. Cities like Los Angeles and Salt Lake City are setting examples by adapting to changing demands with innovative housing solutions.

Meanwhile, in Texas, home values in suburban areas are shifting as inherited properties create both opportunities and constraints for buyers and sellers alike.

Generational Trends in Real Estate Inheritance

Younger generations, including Gen Xers and Gen Zers, will receive the largest share of home equity and play the leading role in how the post baby boomer housing market will look and be valued.

These generations are the key beneficiaries as they inherit properties from older residents.

While this provides an opportunity to build wealth through home equity, it also comes with challenges. Affordability remains a critical issue for young workers, particularly in cities where housing prices have surged over the past decade. Can the younger generation afford to live in these inherited houses?

Despite these challenges, there are opportunities for homebuyers in less competitive markets. Cities like New Orleans and St. Louis, for example, offer more affordable options compared to the Texas metro areas. These trends indicate a growing need for younger generations to strategically maneuver in the market, balancing financial limitations with long-term investment goals.

Preparing for the Sale of Inherited Property

Understanding Financial and Market Challenges

Selling inherited property isn’t always straightforward, especially when financial considerations and a sluggish Texas housing market start to affect your options.

For older residents, reverse mortgage obligations and limited monthly income from social security can complicate property transactions. Additionally, the long-term effects of the great recession continue to influence the housing affordability crunch, making it difficult for some homeowners to get top dollar on the sale of their homes.

For family members managing an inherited home, the process can be complex and full of decisions. Factors like shifting home values, local housing supply, and limited market hours can all influence how and when you choose to sell.

These details matter, especially if you’re aiming for a strong return. Partnering with real estate professionals who understand the local market can help simplify the process and lead to better results.

Why You Need Expert Help to Sell an Inherited Home

Selling an inherited home can feel like stepping into unfamiliar territory. There’s the emotional side, legal paperwork, pricing decisions—and that’s before you even get to the real estate process itself.

That’s why working with an experienced real estate agent matters. A sharp local expert knows how to position your property in today’s housing market, especially in competitive metro areas like Dallas-Fort Worth. From evaluating current home values to reaching motivated homebuyers through targeted social media campaigns, the right agent helps you stay a step ahead.

They also stay dialed in to industry news and shifts in housing supply, offering guidance that helps homeowners make clear, confident decisions. With growing concerns around affordability challenges, especially for younger generations, having a trusted advisor in your corner can be the key to turning an inherited home into a valuable opportunity.

Whether you’re selling a family property or preparing it for its next chapter, expert support ensures the process is handled with care—and that nothing gets left on the table.

Long-Term Care and Silver Wave Housing Solutions

As older residents reach retirement age, many begin to reassess what kind of housing and care will best support the next stage of life.

For some, this means downsizing from a current home. For others, it’s about finding the right blend of support and independence through options like independent living communities, nursing homes, or specialized healthcare services.

These long-term care decisions aren’t just about real estate.

They’re about preserving quality of life.

Whether it’s day-to-day medical help, social connection, or peace of mind, choosing the right setting plays a critical role in overall well-being as needs evolve with age.

Families often step in to help with these decisions, offering perspective and support as loved ones weigh their options. From evaluating care facilities to discussing lifestyle preferences, it’s a process that calls for sensitivity, planning, and sometimes, a shift in what “home” looks like.

Impact of New Reports and Trends

Recent industry news and new reports from both Freddie Mac and the Harvard Joint Center for Housing Studies confirm what many in real estate are already seeing on the ground: the aging of America’s population is triggering a large-scale shift in property ownership, with profound implications for homeowners, homebuyers, and the overall housing market.

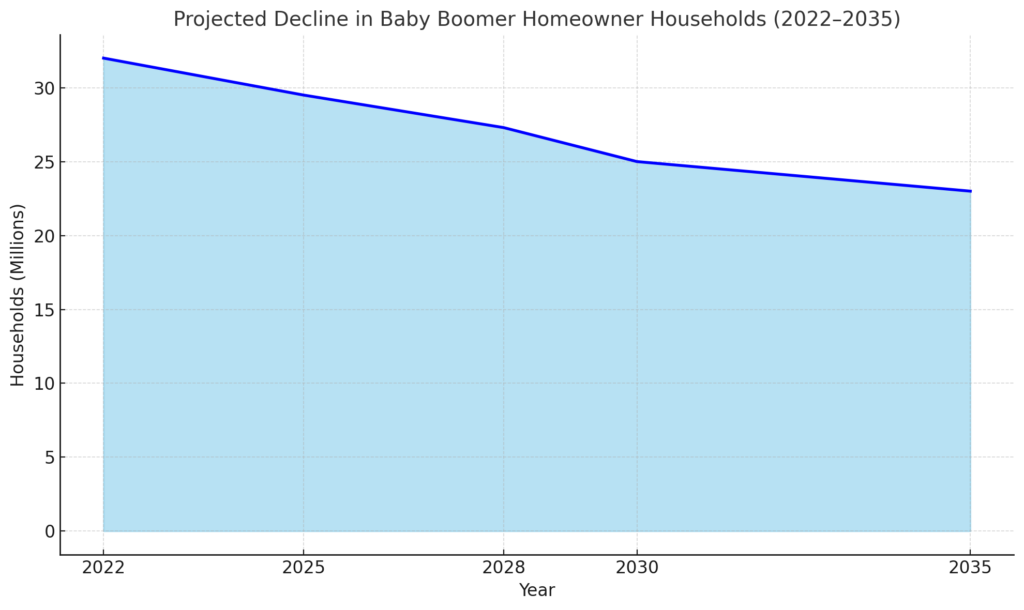

According to Freddie Mac, the number of Baby Boomer homeowner households is expected to drop from 32 million in 2022 to 23 million by 2035—a projected decline of over 9 million homes.

This reduction won’t happen overnight.

By 2028, a decrease of 2.7 million is already expected, as older residents either pass away or move into long-term care facilities. This steady release of inventory is what economists are calling the silver wave of selling—a slow but massive generational transfer of real estate wealth and inheritance.

Meanwhile, the Harvard Joint Center for Housing Studies provides additional insight into the growing urgency behind this transition.

Between 2012 and 2022, the U.S. population aged 65 and older increased by 34%, from 43 million to 58 million. Even more striking, the number of empty-nest households headed by individuals aged 80 and over is expected to more than double by 2040, reaching nearly 17 million.

These aging households are also under financial pressure—over 11.2 million older adults are now considered cost-burdened, spending more than 30 percent of their income on housing expenses.

These trends are not just academic—they signal a growing wave of home sales tied directly to age, financial strain, and life transitions.

For many homeowners, this will mean preparing to sell a current home that’s been owned for decades. For homebuyers, it may present new opportunities—especially in areas where inherited homes become available at a larger scale.

In the coming year and beyond, staying informed about these macro-level demographic shifts will be essential. Whether you’re planning to sell an inherited home or looking to invest strategically, understanding how the silver tsunami is shaping inventory, pricing, and demand can help you make smarter, more timely decisions in a changing market.

Key Takeaways for the Silver Tsunami of Inherited Property in Texas

The silver tsunami is reshaping the housing market in Texas, fueled by an aging population and a historic transfer of real estate through inheritance. These shifts are impacting everything from housing supply and home values to generational wealth and long-term planning.

Whether you’re managing an inherited home, preparing to sell, or weighing long-term care options for an aging loved one, understanding these trends is essential. By staying informed and working with professionals who know the Texas real estate market, homeowners and heirs can turn a complex situation into a strategic advantage.

Need to Sell an Inherited Property Fast? Uncle Tex Can Help

If you’ve just inherited a property and need to sell fast, Uncle Tex is ready to make you an insane cash offer. We buy houses in any condition—no repairs, no cleaning, and no waiting around for a potential buyer.

Whether the house is stuck in probate, packed with years of belongings, or simply needs too much work, we’ll take it off your hands quickly and hassle-free.

Forget showings and agent fees. Just tell us about the property, and we’ll give you a fast, fair, cash offer—often within 24 hours.

You’ve got options. We’ve got the cash. Let’s make a deal.

** Disclaimer: This content discusses broad housing trends like the silver tsunami of inherited property in Texas, changes in empty-nest households, and projected market shifts next year. Information related to the Federal Reserve and credit assistance programs is provided for educational purposes only. Readers should consult legal or financial professionals before making decisions. External links may open in a new window.

*** About the Authors: Hilary Schultz is a licensed Texas Realtor and inherited home specialist which is verifiable at verifiable at TREC, member of the National Association of Realtors, top-rated real estate investors, and recognized authority on the DFW metroplex real estate market. Recently awarded a Zillow Top Agent Badge for her exceptional service and expertise, Hilary takes pride in helping homeowners solve their real estate problems. She serves on the executive board of her local Texas P.T.A. and is deeply involved in the DFW community.

Together with her husband, Patrick, Hilary brings over 40 years of combined experience and a proven track record of completing more than 2,800 real estate transactions. Their approach emphasizes providing DFW homeowners with valuable insights, honest guidance, and a truly personalized experience.Discover why so many Texas homeowners trust Hilary and her team — check out our online reviews and insights and learn how we can help you succeed in your real estate journey