Explains the 2025 process of selling a home in foreclosure in Texas through a practical guide focused on legal procedures, financial options, and sale strategies. Covers key topics including notice of default, auction timelines, deficiency judgments, and alternatives like loan modification, short sales, and cash buyer offers. Emphasizes Texas foreclosure laws and non-judicial processes in the Dallas–Fort Worth region.

Selling a Home in Foreclosure in Texas [2025 Dallas-Fort Worth Guide]

Can You Sell a House in Foreclosure in Texas?

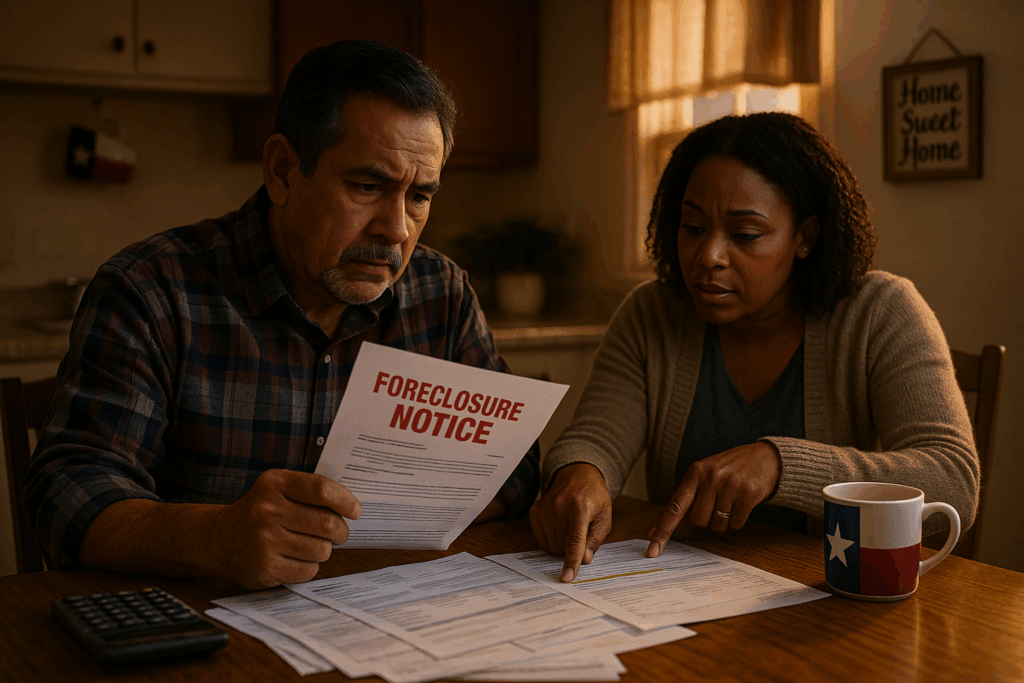

If you started searching selling home in foreclosure Texas after midnight, you already know how quickly a couple of missed mortgage payments can spiral into a certified-mail nightmare.

The goal of this foreclosure guide is simple.

Turn legal jargon into plain talk.

So Texas homeowners can choose the best possible outcome—whether that means a loan modification, a short sale, or handing the keys to a cash buyer before the gavel falls.

Read straight through or jump to the next steps section when time feels short.

Either way, you will finish with a clear plan and a calmer mind.

Table of Contents

- Can You Sell a House in Foreclosure in Texas?

- Foreclosure in Texas Moves Quicker Than You’d Think

- Key People, Key Papers

- The Texas Foreclosure Timeline in Simple Words

- Types of Foreclosure You Might Face

- Foreclosure Avoidance Strategies That Still Work

- Pricing a House When Time Is Tight

- Easy Fixes That Can Boost Your Sale Price

- Courthouse Auction: Where and What Actually Happens

- Life After the Auction in Texas

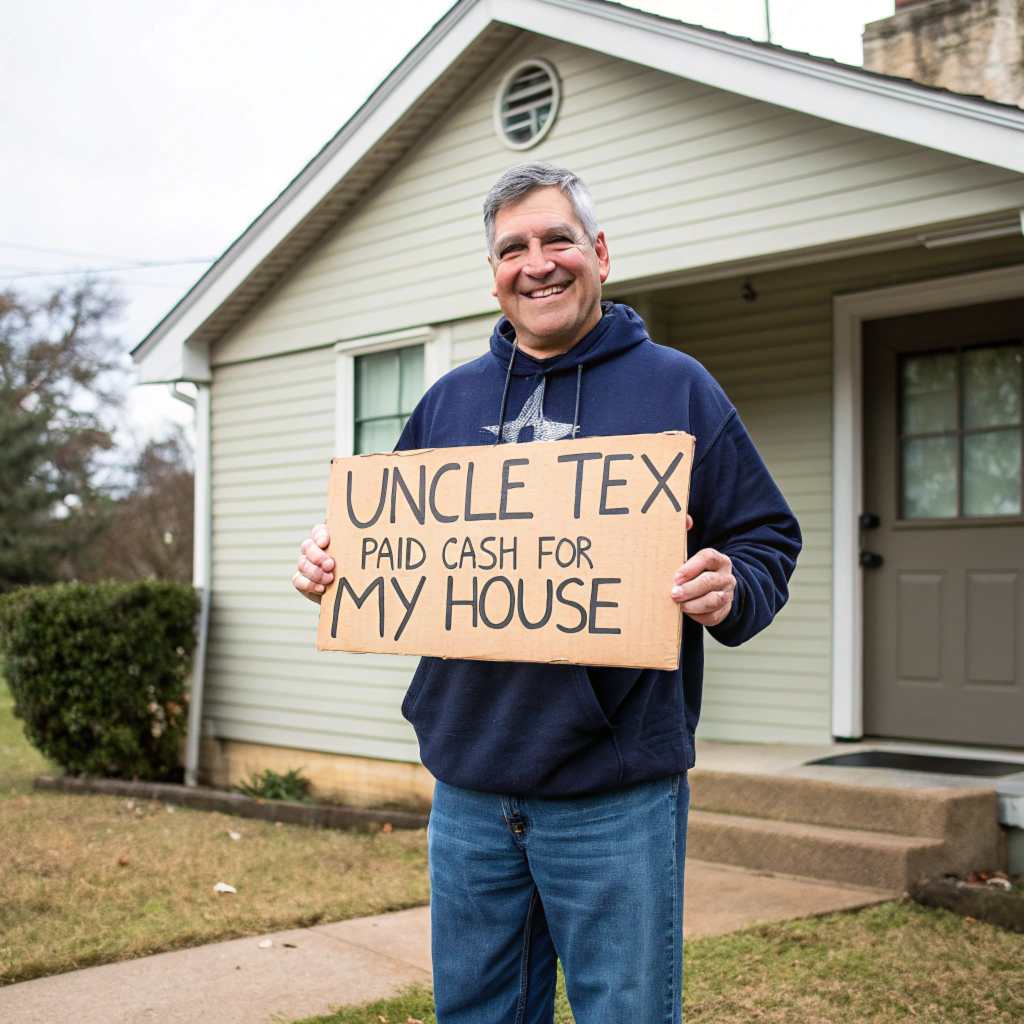

- How Uncle Tex Buys Houses Clears the Chaos

- You Still Have Options—Here’s Where to Begin

- Quick FAQs About Selling a Texas House in Foreclosure

- Need Help? Uncle Tex Buys Houses Is Ready When You Are

Foreclosure in Texas Moves Quicker Than You’d Think

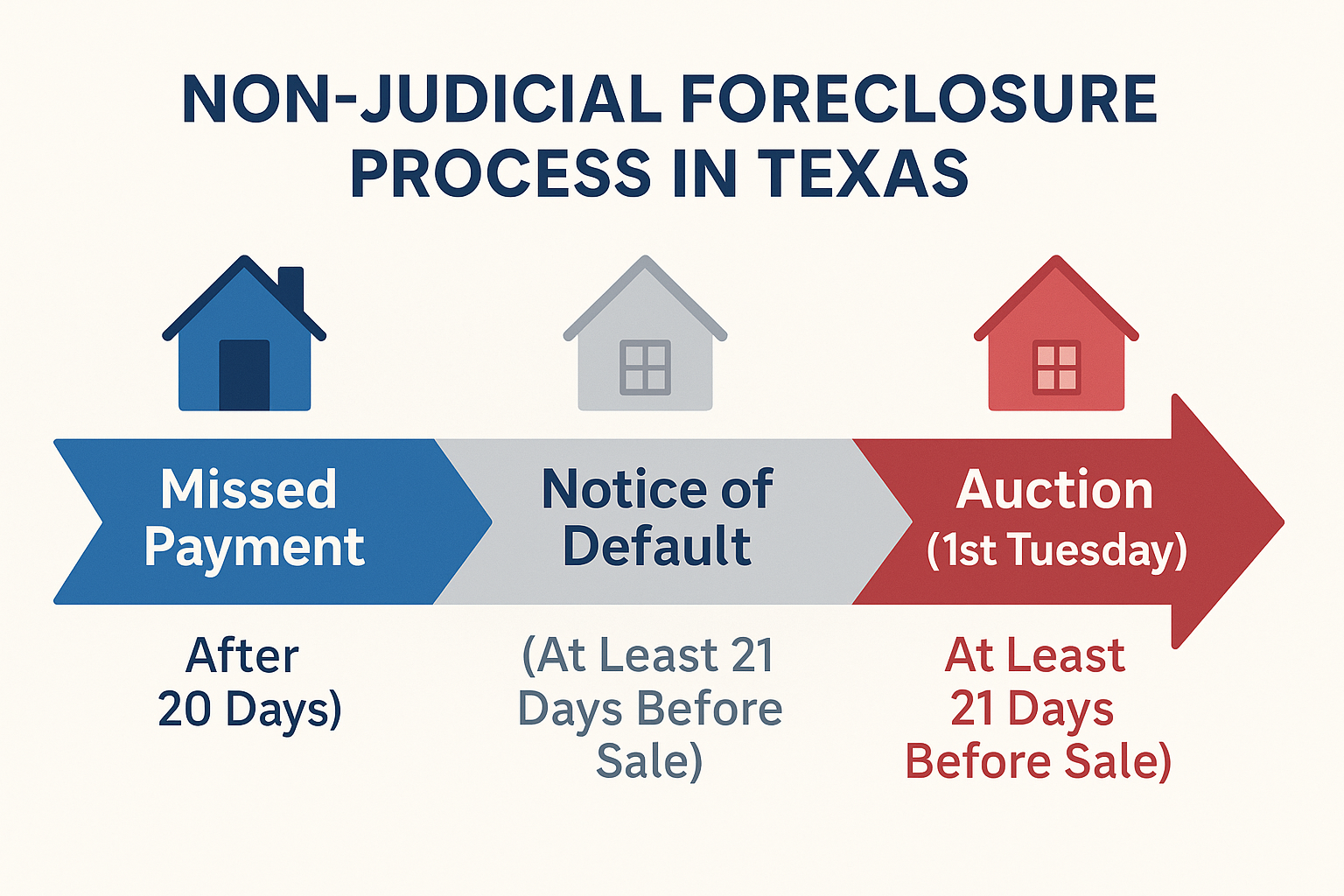

The moment a first missed payment hits the lender’s system, the foreclosure timeline starts.

Under the non-judicial foreclosure process favored under Texas foreclosure laws (Texas Property Code § 51.002), a trustee can schedule foreclosure auction at the county courthouse without filing a lawsuit.

That auction sale nearly always is monthly on the first Tuesday, and once the house sells, there is no redemption period.

The speed surprises many property owners, but the logic sits in long-standing Texas law: a fast transfer of real property is thought to protect the wider real estate market from drawn-out distress.

Knowing this tempo will shape every decision you make from here on.

Key People, Key Papers

People Who Control the Clock

- Mortgage servicer – collects the monthly payments, adds late fees, and launches each notice of default letter.

- Mortgage lender (or mortgage holder) – owns the mortgage loan and must approve any loan modification, short sale, or new loan payoff.

- County Clerk’s office – records the public notice and stamps the notice of sale with your property address/ zip code, and auction date.

- County court – venue for the slower judicial foreclosure process if a lawsuit is filed.

- Cash home buyer / real estate investor – can step in with a certified-fund cash offer that can stop foreclosure quickly.

Paperwork To Save In One Folder

| Document | Why It Matters |

|---|---|

| Loan agreement | Details interest rate, escrow rules, and default triggers. |

| First notice of delinquency | Proves the official start of the foreclosure process timeline. |

| Foreclosure notice / Notice of Default | Sets the cure date and shows when foreclosure begins. |

| Notice of Sale (sent by certified mail) | Locks the property onto the courthouse calendar. |

| Trustee’s public notice post | Confirms docket slot—often labeled Line 2—and starting sale price. |

The Texas Foreclosure Timeline in Simple Words

The entire arc, from first delinquency to the final gavel, often wraps up in just 140 days. That’s why quick, informed decisions beat wishful thinking every time.

| Calendar Timeline | What Happens | Moves You Can Still Make |

|---|---|---|

| Day 0 | Mortgage company flags the first late payment. | Call the servicer; ask about loss mitigation or temporary forbearance. |

| Day 30-60 | Second bill cycles; late fees double; foreclosure notice warning may arrive. | Gather pay stubs, medical bills, and other proof of financial hardship. |

| ~ Day 90 | Official notice of default filed with the County clerk’s office. | Submit a complete loan modification packet or list with sell my house fast type terms that attract potential buyers. |

| ~ Day 110 | Notice of Sale mailed; auction set for the first Tuesday monthly. | Secure a written offer from a cash home buyer or finalize a short sale package. |

| Auction Day (in morning) | Trustee reads legal description, tax lien status, and minimum bid. The highest bidder pays certified funds; the deed transfers to the new owner. | If sale closes, prepare to vacate; non-judicial rules offer no second chance. |

Types of Foreclosure You Might Face

Before you plan your next move, it helps to know what kind of foreclosure you’re actually dealing with. In Texas, there are two main paths, and they operate very differently.

- Non-judicial foreclosure sale – Powered by a deed of trust clause; no judge, no courtroom, just written notices and a courthouse auction.

- Judicial foreclosure process – Starts when a lender files in county court; slower but wrapped in formal court order checkpoints.

The type of foreclosure that applies to your situation sets the pace, the paperwork, and in many cases the negotiation style.

Foreclosure Avoidance Strategies That Still Work

Loan Modification — Lower Payment, Longer Runway

Great fit when income has dipped but not vanished. Provide a hardship letter plus proof of fresh earnings. Expect a trial period of reduced mortgage payments before the servicer finalizes new terms.

Short Sale — Get Out From Under Water

If property values have fallen below your balance, the lender may approve a short sale. Buyers submit offers; the bank signs off; you leave without a deficiency judgment. It is a complex process that demands patience, but it often saves credit scores. For personalized, no-cost guidance, consult the HUD-approved Texas housing counselor directory to locate certified foreclosure counselors in your region of Texas.

Home Equity Loan or New Loan — Refinance the Stress

Strong equity and acceptable credit? A home equity loan or new loan can roll arrears into a single note. Compare interest rate quotes and closing costs through reputable online tools.

Reverse Mortgages — Seniors Have a Safety Valve

For homeowners 62 and older, reverse mortgages convert equity into cash that clears arrears while you stay put. Counseling is mandatory under the Texas Property Code and relevant federal laws. Before applying, review the HUD HECM reverse-mortgage program to confirm eligibility, counseling requirements, and payout options.

Cash Buyer Exit — Fastest Road to Certainty

Sometimes the only option as the auction date nears. A verified investor wires funds, pays closing expenses, and wraps the real estate transaction before the trustee starts reading docket numbers.

Pricing a House When Time Is Tight

An effective asking price blends urgency with fairness.

Start by studying local housing market trends for your ZIP code, plus nearby hot spots like Fort Worth, San Antonio, or Arlington TX.

Subtract repair estimates from each comparable and set the ask price just below similar listings.

That figure sparks calls from potential buyers without leaving money on the table.

Easy Fixes That Can Boost Your Sale Price

Small and quick home improvements can boost curb appeal and push offers closer to fair market value:

- Tighten loose doorknobs, handles, or cabinet pulls. Small repairs like these give the impression of a well-maintained Texas house and can influence potential buyers during showings.

- Neutralize pet odors and deep clean carpets. Odor is one of the top deal-breakers during the sales process. Use this step to appeal to both cash buyers and traditional buyers

- Replace fogged windows or torn screens.

- Patch nail holes and apply neutral paint where scuffs show.

- Fix minor faucet leaks or running toilets. These are red flags for inspectors and finanical lenders, and they can be cheap to repair.

- Rake leaves, edge walkways, and clear gutters to avoid last-minute inspection points.

Time is short, but a day of elbow grease can mean a material swing in the final sale price.

Courthouse Auction: Where And What Actually Happens

Starting at 10 a.m. and up until around 1pm, a trustee stands at the entrance of the county courthouse—sometimes outside, sometimes in a hallway—holding a stack of printed files.

One by one, they read the public notice for each property on the docket. That includes the legal description, ZIP code, and auction position. Your home might show up early in the list, or sometimes later. It is unknown and dependent on the timing of the trustee in charge.

Bidders, mostly real estate investors, wait nearby with cashier’s checks in hand.

Once the trustee announces the sale price, the highest bidder becomes the new owner on the spot. No judge. No courtroom. Just a loud voice and fast-moving paperwork.

If nobody meets the lender’s minimum, the house becomes a foreclosed home and re-enters the real estate market later—usually as a bank-owned REO listing.

Either way, the property owner loses title that day. No delay. No appeal. No second chance.

If you’re in North Texas, auction days are held in person at the county level. Here’s where they take place across the region’s three largest counties:

| County | Auction Location | Major Cities Covered |

|---|---|---|

| Tarrant County | West side of the building at 100 West Weatherford Street, Fort Worth, TX | Fort Worth, Arlington, Grand Prairie, Bedford, Euless, Roanoke, Hurst, North Richland Hills, Haltom City |

| Dallas County | North side of the George Allen Courts Building, 600 Commerce St, Dallas, TX 75202 | Dallas, Irving, Garland, Mesquite, Balch Springs, DeSoto, Duncanville, Lancaster |

| Collin County | 2100 Bloomdale Road, McKinney, TX | Frisco, Plano, McKinney, Allen, Princeton, Anna, Melissa |

Always double-check with the local county clerk’s office or your local foreclosure bulletin for last-minute updates especially during holidays or severe weather days.

Life After the Auction in Texas

Losing your home from foreclosure is painful but doesn’t mean the story ends.

…it just shifts.

There are still financial and legal pieces to deal with, and facing them head-on gives you the best chance at a full recovery.

Deficiency Judgment

In some cases, the mortgage lender may still come after you for the unpaid balance on your mortgage loan.

This is called a judgment of deficiency.

It happens when the final sale price at auction doesn’t cover the full payoff amount, and the lender chooses to sue for the difference.

While Texas foreclosure laws generally offer protection against this in non-judicial cases, exceptions exist—especially for loans tied to a home equity loan, or certain notes backed by federal laws or government-insured programs.

If you’re unsure whether this applies to you, get legal advice as soon as possible.

A good real estate attorney can review your loan agreement, explain your rights under Texas law, and help you respond to any future court proceedings.

Mortgage Foreclosure & Credit Impact

A mortgage foreclosure can drop your credit score by 100 to 160 points, and the effects can last several years. That doesn’t mean you’re locked out of homeownership forever, but it does mean you’ll need a plan. To map out a credit-recovery plan after foreclosure, consult the CFPB guide to credit reports and scores for proven, step-by-step strategies.

Focus on small, consistent wins:

- Pay every bill on time, every month

- Avoid new hard inquiries unless truly necessary

- Start rebuilding a track record of financial responsibility

After two years of clean history, you may qualify for a new loan through FHA or VA programs and even sooner if the financial hardship was well-documented.

Federal Tax Implications

Forgiven debt doesn’t always vanish quietly. In many cases, the IRS treats canceled debt as income, which could lead to a surprise tax bill.

If your lender forgives a balance after the foreclosure sale, consult a CPA or housing counselor immediately. You may be eligible to file IRS Form 982, which can exclude that income under specific hardship scenarios.

This is one of those moments where the right paperwork at the right time can save you thousands—and turn a hard year into a manageable one.

Facing these realities early gives you the tools to deploy a long-term recovery strategy—one that’s proactive instead of panicked.

The complexities of foreclosure don’t end at the courthouse steps, but with the right plan and support, you can rebuild faster than you think.

How Uncle Tex Buys Houses Clears the Chaos

Our family-run team has completed more than 2,800 real estate transaction, many with foreclosure sales right around the corner.

We know how to help you…. today!

Right now!

Our home buying process is straightforward and aims to help you prevent foreclosure:

- No obligation consultation – Ten-minute call or form. We collect specific information: address, payoff, repairs, and any active court proceedings.

- Walk-through – We verify structure and note an needed repairs.

- Cash offer & closing date – Written figure in 24 hours. Accept, and we coordinate with the mortgage company to cancel the auction. Funds wire on the day of closing, and you leave with cash, not anxiety.

For many families facing financial distress, it is the best way to dodge lingering fees and sleepless nights.

You Still Have Options—Here’s Where to Begin

Foreclosure isn’t the end of the road.

Even if things feel uncertain right now, there are practical, immediate steps you can take tonight to regain a sense of control.

These aren’t complicated.

But they do matter.

They can help you avoid last-minute mistakes as the foreclosure timeline moves forward.

Start with your loan agreement. Highlight every key date, clause, and communication notice. Knowing where you stand in the sales process gives you leverage in the days ahead.

Mark the auction date on a physical calendar. In Texas, most foreclosure auctions land on the first Tuesday of each month, and under the non-judicial foreclosure process, there’s no grace period after the sale. Let that date be a motivator, not a surprise.

Use online tools and legal resources. The Texas State Law Library offers detailed guides on Texas foreclosure laws, legal procedures, and loss mitigation strategies. Confirm what applies to your situation based on your loan agreement and the type of foreclosure you’re in.

Compare your best options side by side. Are you a candidate for a loan modification? Could a short sale help avoid long-term damage? Or would working with a cash home buyer provide the most relief before the foreclosure auction? Look at what’s realistic—not just ideal.

Act. The single worst move is doing nothing. Early action often leads to a best possible outcome, especially when dealing with complex rules under Texas Property Code and federal laws.

Quick FAQs About Selling a Texas House in Foreclosure

Can you legally sell a house while it’s in foreclosure in Texas?

Yes. Texas homeowners can list or accept a cash home buyer offer any time before the foreclosure auction gavel drops. Under the Texas Property Code (§ 51.002) a non-judicial foreclosure timeline and process begins after the mortgage servicer records the notice of default at the County clerk’s office and sends it by certified mail. Until the official notice of sale is read on the courthouse steps, you may pursue a short sale, loan modification, or sale from a traditional listing. Get legal advice early, because your mortgage lender must approve the payoff and release the deed of trust. A quick sale can be the best way to clear missed payments and avoid further hit to credit.

Will selling before auction stop the foreclosure and protect my credit?

Yes. If your property sale pays the mortgage loan in full. A completed payoff forces the lender to cancel all public notice filings and withdraw the auction, preventing a recorded foreclosure on your credit report. Even accepting slightly under fair market value can save 100-plus FICO points and months of late fees. Popular exit routes include a lender-approved short sale, a quick closing with a cash house buyers, or refinancing arrears with a new loan or home equity loan. Always secure written confirmation that the mortgage holder will dismiss the auction sale once funds clear.

How long do I have before the foreclosure auction in Dallas or anywhere in Texas?

The foreclosure timeline is short—about 120 to 140 days from the first missed payment to the auction at the county courthouse.

- Starting Day Zero: Foreclosure begins when the mortgage company records delinquency.

- Around Day 90: A Notice of Default arrives, triggering formal foreclosure procedures.

- Around Day 110: The Notice of Sale sets the final auction date.

That leaves only a few weeks to close a loan modification, price a short sale, or accept a fair price from a real estate investor. Act quickly—once the auction process completes, the highest bidder becomes the new owner, and a judgment for deficiency of payment may follow.

If the home sale doesn’t cover my balance, can the bank or lender sue me for a deficiency judgment?

Possibly could happen. In a typical non-judicial foreclosure sale the lender can seek a deficiency judgment for the price gap between the sale price and the mortgage debt owed, but Texas law caps the claim at the home’s fair market value on auction day. Loans tied to certain federal laws or handled through the judicial foreclosure process give lenders wider latitude. Protect yourself by ordering an independent appraisal of current property values, requesting the lender’s payoff calculation, and reviewing defenses through the Texas State Law Library or a real estate attorney. Early documentation and direct negotiation offer the best possible outcome.

Need Help? Uncle Tex Buys Houses Is Ready When You Are

If you’re facing missed mortgage payments or have received a notice of foreclosure, we’re here to offer real support.

At Uncle Tex Buys Houses, we work directly with Texas homeowners to stop foreclosure fast—often by making a fair cash offer that helps you avoid the foreclosure auction altogether.

No pressure.

No gimmicks.

Just real solutions from a local team that understands the complexities of foreclosure.

Call us today or request your no-obligation consultation—we’re ready to help you take the next step.

Contact Us

We would love to hear from you! Please fill out this form and we will get in touch with you shortly.

**Disclaimer: This guide is provided for informational purposes only and should not be construed as legal advice or financial counsel. Foreclosure procedures and property sales in Texas, including in areas like Dallas, Plano, and Frisco, involve complex legal processes governed by state laws and federal regulations. If your house is in foreclosure in Texas, consult with a qualified attorney or housing counselor to understand your rights and available options. While selling to a cash buyer can be a good option for homeowners facing financial difficulties, each situation is unique and should be evaluated individually to ensure a fair price and compliant resolution.

*** About the Authors: Hilary Schultz, a licensed Realtor in Texas and a Zillow Top Agent for excellence in service, co-leads Uncle Tex Buys Houses alongside her husband, Patrick Schultz. With over 2,800 real estate transactions completed, they provide Texas homeowners with clear and dependable guidance—especially when facing complex issues like foreclosure. Their family-operated business is grounded in trust, experience, and a deep understanding of the DFW property landscape. Hilary is also actively involved in her community, serving on the executive board of her local Texas PTA. You can see customer ratings, verify her TREC license, visit her Zillow profile, or learn more about the company to understand their approach.